Office to Residential Conversions: Opportunities and Challenges – and a Real-Life Case

By: José Luis Escotto

Readapting Office Spaces: A Post-Pandemic Trend

The COVID-19 pandemic reshaped global real estate markets, prompted companies to shift to remote work trends, and left office buildings vacant in major metropolitan areas. As cities struggle with declining office demand, especially in the outdated Class B spaces, office-to-residential conversions have emerged as a potential solution to repurpose underutilized properties while addressing housing shortages in cities like New York City. However, these conversions are not a solution in every case; they come with structural, regulatory, and financial challenges that vary by each building’s location.

One such example is the building Josefa (Reforma 390) in Mexico City, a mixed-use transformation of the former CitiBanamex headquarters into a high-end residential and retail development. This case highlights the distinct obstacles and opportunities of repurposing office spaces, particularly in cities with evolving seismic codes and a complex regulatory and political environment like Mexico City. However, while office-to-residential conversions gained traction post-pandemic, Reforma 390 was acquired before the pandemic in 2019. This project was not a reaction to the pandemic and its life-changing consequences, but was a part of the developer’s long-term vision to incorporate the multifamily rental market in Mexico City, a segment that has historically been underdeveloped compared to other major global cities.

The project’s old and new façade designs

The Challenges of Office-to-Residential Conversions

While repurposing office buildings may seem like an efficient and obvious way to revitalize urban spaces and address living space shortages, several relevant challenges complicate these projects, such as:

Structural Limitations: office buildings often have complicated floor plates and limited access to natural light, making residential layouts difficult to configure.

Building Code Compliance: older office structures may not meet modern residential codes, needing significant and expensive retrofitting and restructuring.

Financial Feasibility: The cost of conversion can often match or exceed the cost of ground-up construction, especially when upgrading HVAC, plumbing, facade systems, and, in this case, structural integrity. This is due to Mexico City’s high seismic zone.

Market Demand & Zoning Restrictions: in some cases, zoning regulations prohibit residential conversions or require special permits, adding another layer of complexity.

Lack of Incentives in Mexico: Unlike in the United States, where tax credits for including affordable housing, for example, can help cushion conversion costs, Mexico offers little to no financial incentives for adaptive reuse, let alone office-to-residential conversions. Developers in Mexico City must rely entirely on private funding, making conversions financially riskier and less attractive than new developments.

Reforma 390: A Unique Transformation Amid Adversity

Josefa is a prime example of an office-to-residential conversion that had to navigate multiple challenges, including Mexico City’s seismic regulations and pandemic-era construction difficulties, ranging from multiple increases in iron costs and workforce shortages to limited work hours and government office closings. Originally designed as an office building in the 1970s, the structure was repurposed into a luxury residential and retail development, blending modern design alluding to Mexican traditional figures with historic surroundings in the city’s most prominent and one of the busiest avenues, where icons like the Angel of Independence and Torre BBVA stand today.

The Angel of Independence and Torre BBVA (back left)

Mexico City’s seismic vulnerability is a critical and determining factor in any major redevelopment. Building codes were updated after the 2017 and 2019 earthquakes to require reinforced structural elements, additional bracing, and stricter compliance measures for new residential buildings. Converting Reforma 390 required a comprehensive structural analysis and reinforcements, making the project significantly more complex than standard adaptive reuse. This was due to the construction code requiring different structural safety factors depending on the building’s use.

Construction began during the COVID-19 pandemic, causing unexpected delays and cost overruns. Supply chain disruptions impacted material availability and materials costs, particularly for imported glass, steel reinforcements, and HVAC components, all of which the project updated from the previous offices after leaving the building in vanilla condition. Labor shortages and health restrictions further delayed progress, forcing the developer to adapt to new safety protocols and restricted work schedules and hours that required for them to implement new logistics constantly.

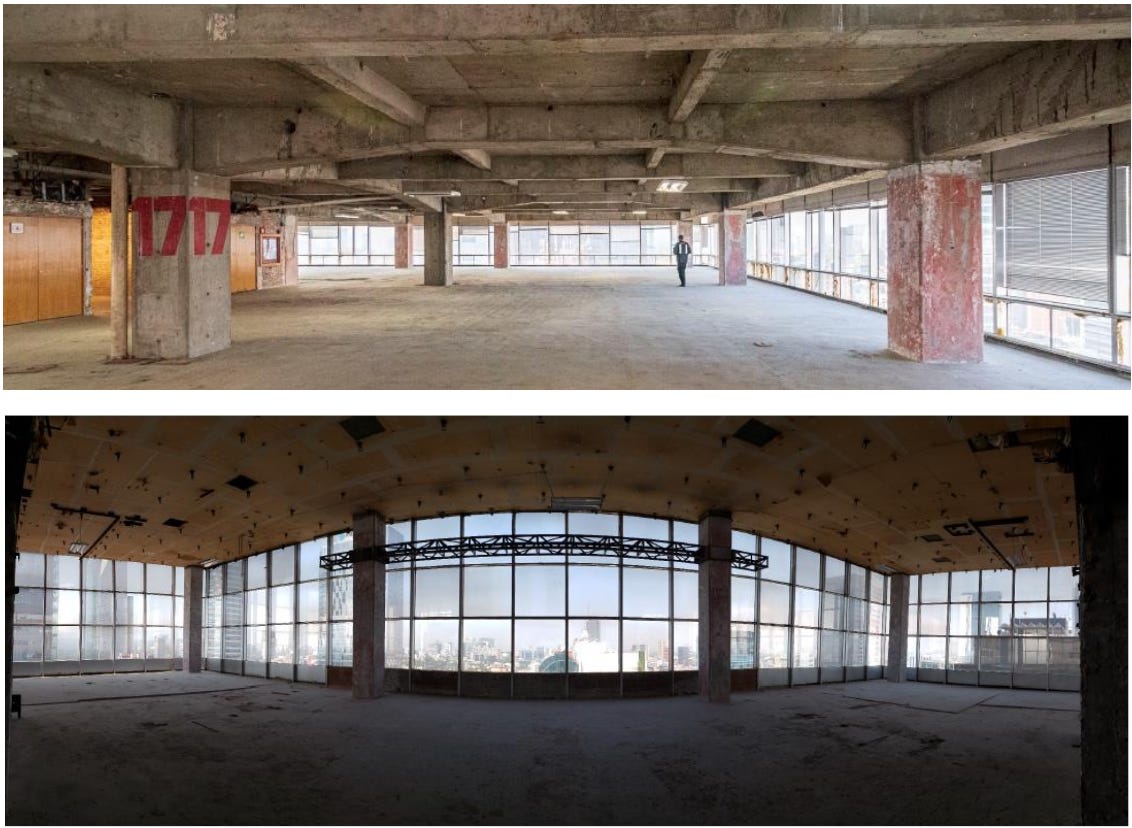

Residential and Amenities Floors in Vanilla Condition

Despite these hurdles, the project successfully reimagined a once-decaying office building into a vibrant, mixed-use development. The design preserved the tower’s sleek and modern aesthetic and optimized floor plans to accommodate luxury residences with shared amenities and retail spaces for high-end restaurants and bars. The 364-unit project incorporated new glasses for the façade to make the most of the building’s exposure to natural light, air-conditioning – highly uncommon in residential spaces in Mexico City –, and a wide variety of amenities on every floor including lounges, gaming areas, grills, meeting rooms, two gyms, and entertainment kitchens.

The Future of Office Conversions in Mexico City

Reforma 390 serves as a case study for future office-to-residential conversions and multifamily developments in Mexico and beyond. While adaptive reuse presents immediate and attractive benefits – sustainability, urban revitalization, and efficient land use – the process remains highly technical, financially risky, and extremely dependent on flexibility on regulatory issues. This is further complicated with markets like Mexico's still trying to incorporate multifamily assets.

For cities like Mexico City, where seismic risks and zoning restrictions complicate conversions, policy incentives and accelerated permitting could help unlock the full potential of underutilized assets. However, without tax credits, subsidies, financial incentives, or programs like the recent City of Yes, like those available in the United States, developers in Mexico must carry the full economic burden. This makes office-to-residential conversions an inherently high-risk venture, leaving them with the traditional ground-up development choice for now.

As cities continue to evolve, projects like Reforma 390 demonstrate the resilience and innovation needed to shape the future of real estate development. They also highlight the need for government support and financial incentives to make these projects more viable and attractive to developers outside the United States.

More about the Author: José Luis Escotto

Does Mexico offer historic tax credits? Another way developers are making O2Rs pencil out