The NYU Schack REIT Investment Fund: a unique opportunity for students to build a competitive advantage

By: Scott Robinson

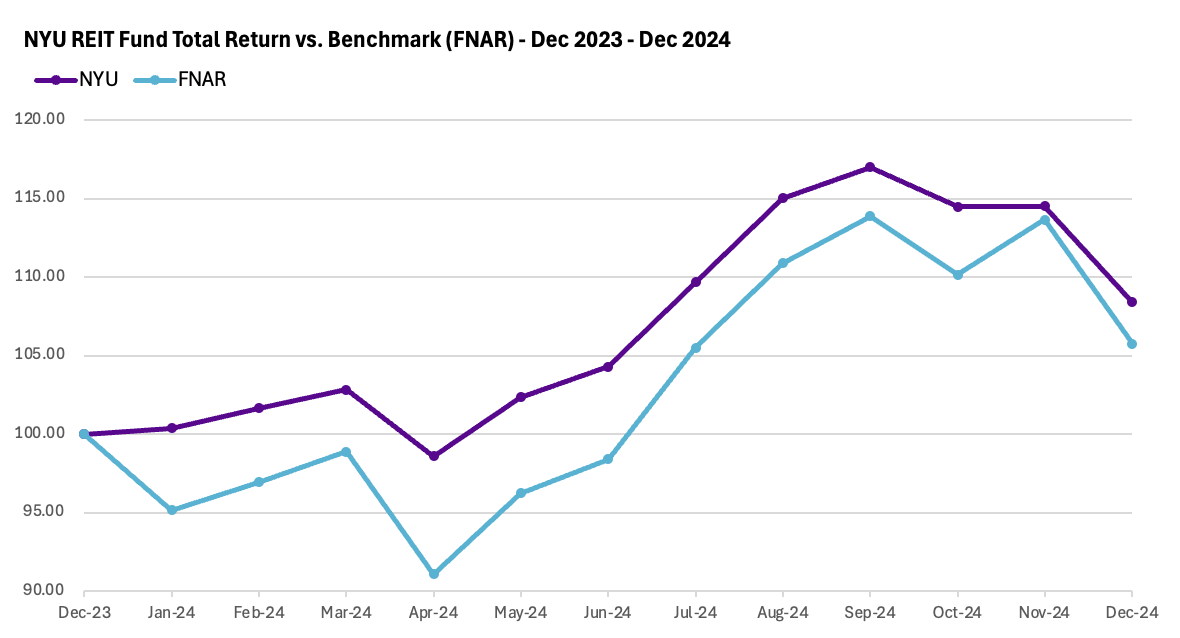

The NYU Schack REIT Center’s REIT Investment Fund is a unique and very compelling extra-curricular activity that gives students a hands-on, real-world experience in real estate securities investment analysis and management. The Fund is entirely run by students with appropriate oversight and specific guidelines. It is my privilege to serve as the Fund’s faculty advisor and my thrill to state that the Fund has outperformed its Nareit benchmark since inception in Fall 2023!

Serving as advisor to the Fund is different from my typical teaching experience. Yes, I host “teach-in” sessions for each new cohort, discussing financials statements, REIT earnings and valuation methodologies, but this is a very small part of my engagement. For the most part, I am more of a coach or mentor, providing guidance and insight, offering suggestions, critiques and lots of kudos. But this experience has also sparked me to think about high-performing teams and how they evolve. So, I have been doing a lot of informal research on the characteristics of high-performing teams and how to cultivate various relevant behaviors. There has been countless such formal research conducted with few of the findings being “absolute”, but I have found the following to be ever-present among our Fund students:

Accountability: Each of our weekly Friday morning sessions begin with a candid discussion of each investment position. The lead analyst for each position is noted, along with the position performance to date. Regardless of performance, each analyst needs to constantly justify the position by answering questions and providing updated insights about the company. This level of accountability instills each participate with an ownership mentality and deep sense of responsibility to the larger group.

Communication: We like to say that “tourists are not allowed” in the Fund. Each student is expected to be an active member of the team, conducting research, asking questions, challenging assumptions, sharing concerns, etc. Additionally, each student is required to vote on each investment action. No matter the point the view or topic being discussed, each student is required to treat each other with the utmost respect. This type of open communication creates a consistent flow of information with “compounding” benefits.

Trust: I encourage mature, collegial behavior among the students, but I have found that it’s not necessary. Students excitedly share knowledge and investment ideas. Because each student is required to vote on each investment, they are forced to be knowledgeable enough to ask meaningful questions. They engage constantly throughout the week, sharing industry news, industry gossip and general economic news, and happily make introductions to industry professionals. They all very quickly learn that they win together and lose together; nothing in the group happens individually. As such, a strong sense of trust has organically developed among the students, transferring each semester to the new cohorts.

Curiosity: Students actively seek participation in the Fund, they want to be involved and effortlessly commit a lot of time and energy to the effort because they know the value they earn is a direct result of the effort put forth. As such, a sense of curiosity seems to build its own momentum among the group.

The students will be hosting several events this semester, including leadership interview and performance updates. Additionally, they also frequently post on social media, particularly LinkedIn. I strongly encourage you to follow the Fund and each student.

Serving as faculty advisor to this rolling-cohort of students is incredibly rewarding and I look forward to supporting new students each semester. Please reach out to me or any of the current or past Fund students to learn more about our activities or to “talk shop” about REITs!

Background

The Fund was created to enable students to be part of a truly one-of-a-kind experience while pursuing their degree requirements. The Fund’s formal objectives include:

To provide Schack students with an opportunity to apply and integrate real estate institute teachings in the pursuit of investment management. Key skill sets developed through the Fund experience include:

Industry and sector analysis

Accounting and financial analysis

Security analysis and portfolio management

Presentation skills to an audience of peers and advisors

To preserve and grow the funds under management

To allow students the opportunity “to run their own business”, to think like principals and to further develop management and teamwork skills

Guidelines

The Fund can invest exclusively in securities issued by US-listed REITs (Real Estate Investment Trusts), REOCs (Real Estate Operating Companies), and Homebuilders. The Fund is benchmarked against the FTSE Nareit US All REIT index(1). The Fund may not incur debt, so cannot trade on margin or “short” securities. The Fund may not trade derivatives, commodities or direct interest in real estate or other non-marketable securities. While this may sound limiting, we have discovered it is a very large pond from which we can generate alpha!

Structure

The Fund is structured with a Management Team comprised of President, Portfolio Manager(s), Lead Analyst, Auditor, Trader and Head of Economic Analysis. The sector is then divided into property type teams, each with a lead analyst, including Residential Healthcare, Retail, Industrial, Lodging & Gaming, Office, Opportunistic, Mortgage and Economic Analysis. In total, we typically have 30 students in each cohort. We formally meet weekly on Friday mornings with each sector team meeting separately each week. We also communicate constantly through a few WhatsApp groups. The flow of information can be intense!

The REIT Center

The Fund is also supported by Schack and the REIT Center on marketing, research and various industry engagement initiatives. The REIT Center hosts the annual REIT Symposium every April, which provides a rare opportunity for Fund students to share their performance, market insights and “lessons learned”. The REIT Center also hosts speaker series (see Leadership Series on Schack’s YouTube page) and guides students through applied research efforts. If you want to be involved in any of these activities, please contact me directly.

Footnotes: