Understanding REITs: Exploring UPREIT vs. DownREIT Structures, Tax Benefits, and Investment Advantages

By: Collin Dallas – Wu

Understanding REITs and Their Structure

Real Estate Investment Trusts (REITs) are companies that own, manage, or finance income-generating properties across a wide range of sectors. Established in 1960, REITs were designed to give individual investors access to income-producing real estate—offering liquidity and diversification benefits similar to publicly traded securities (1). Investors can gain exposure to REITs through public stock exchanges, mutual funds, and exchange-traded funds (ETFs) (1). Nearly all target date funds, a common feature in 401(k) plans, include REIT allocations, while many pension plans—serving teachers, firefighters, nurses, state employees, and others—rely on REITs for real estate exposure (4).

REITs are structured to pass most of their taxable income to shareholders through dividends. This distribution model allows REIT investors to avoid double taxation, as REITs themselves are generally not taxed at the corporate level, provided they distribute at least 90% of their taxable income to shareholders (2).

The UPREIT vs. DownREIT Structure

When investing in REITs, investors may encounter two distinct structures: UPREITs (Umbrella Partnership REITs) and DownREITs. Both structures provide unique benefits, particularly in terms of tax deferral and investment flexibility.

UPREIT: The Most Common Structure

The UPREIT concept was introduced in 1992, during a period when the real estate market faced significant challenges. The first UPREIT structure emerged with the Taubman Centers IPO in 1992, allowing property owners to contribute their assets to a partnership controlled by the REIT in exchange for Operating Partnership (OP) Units. This structure provided a tax-efficient method for property owners to transition into REIT ownership without incurring immediate tax liabilities (3).

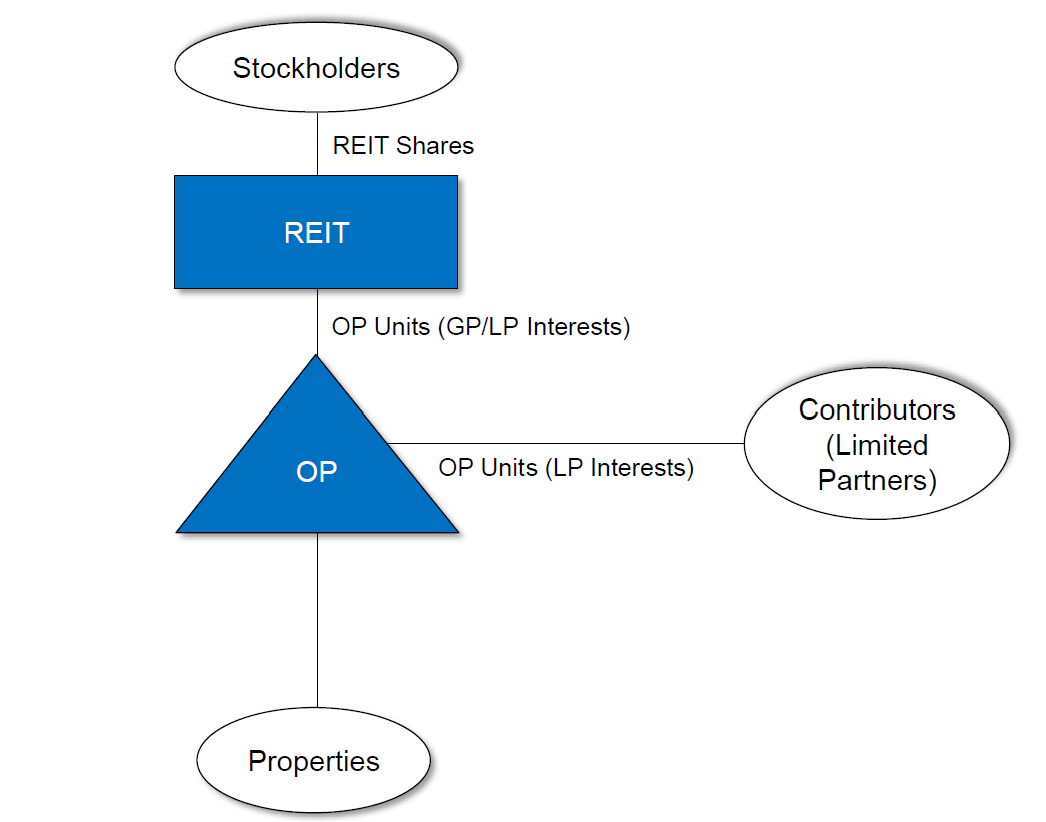

UPREITs allow property owners to contribute real estate assets to the operating partnership (OP) that owns all the properties rather than selling properties directly to the REIT. This structure provides a tax-deferred exchange under Section 721 of the Internal Revenue Code (3).

Picture #1 is retrieved from (2) Why do property REITs have operating partnerships?

Understanding OP Units

Operating Partnership (OP) Units are a fundamental component of the UPREIT structure. In this setup, the REIT acts as a limited partner in the OP, typically holding most of the outstanding OP Units, constituting its primary assets. The REIT acquires these OP Units by contributing cash proceeds from its IPO or other equity offerings, maintaining a one-to-one ratio between outstanding REIT Shares and OP Units (2).

When the REIT issues additional shares, it contributes the proceeds to the OP in exchange for more OP Units (1). Similarly, when preferred shares are issued and sold, the REIT transfers the cash proceeds to the OP in return for preferred units that mirror the economic terms of the preferred shares (2). The remaining OP Units are held by limited partners—other than the REIT—who contribute their interests in property-owning entities or direct property holdings to the OP on a tax-deferred basis. This structure enables tax-efficient property contributions while ensuring alignment between REIT shareholders and OP Unit holders.

Key advantages of UPREITs include:

Tax Deferral: Property owners defer capital gains taxes by receiving OP units instead of cash (3).

Liquidity and Diversification: Property owners gain exposure to a broader, professionally managed real estate portfolio (6).

Conversion Flexibility: OP units can typically be converted into REIT shares on a one-for-one basis after a holding period, allowing investors to monetize their holdings (4).

Estate Planning Benefits: If OP Unit holders pass away before converting their units, their heirs may benefit from a step-up in tax basis, potentially eliminating built-in capital gains tax obligations (4).

While UPREITs offer several advantages and investment flexibility, they also present different risks and complexities that investors should consider:

Limited Voting Rights: OP Units typically lack voting rights at the REIT level and provide only limited voting or consent rights at the OP level. Some UPREITs address this by issuing a special class of voting stock at the REIT level, allowing OP unitholders to have a say in governance decisions aligned with their equity investment (2)

Liquidity Concerns: If the REIT is delisted from its exchange, the liquidity of REIT shares issued upon the redemption of OP Units may be significantly reduced or nonexistent.

Affiliate Status Restrictions: If a contributing limited partner becomes an "affiliate" of the REIT, their ability to sell shares may be restricted due to insider trading regulations or the short-swing profits rule under Section 16 of the Securities Exchange Act of 1934 (2).

Tax Deferral Risks: Contributing limited partners who rely on the contribution to defer tax obligations may face unintended consequences if they lose control over the future sale or refinancing of the contributed property. Such events could trigger a tax liability. A tax protection agreement can partially mitigate this risk.

DownREIT: A More Customized Approach

Unlike a UPREIT, a DownREIT allows property owners to form a partnership with a REIT for specific properties rather than contributing all their assets to a centralized umbrella partnership (4). This structure is often used when a property owner wants to retain a greater degree of control over specific properties while still benefiting from REIT ownership.

Key Differences Between UPREITs and DownREITs

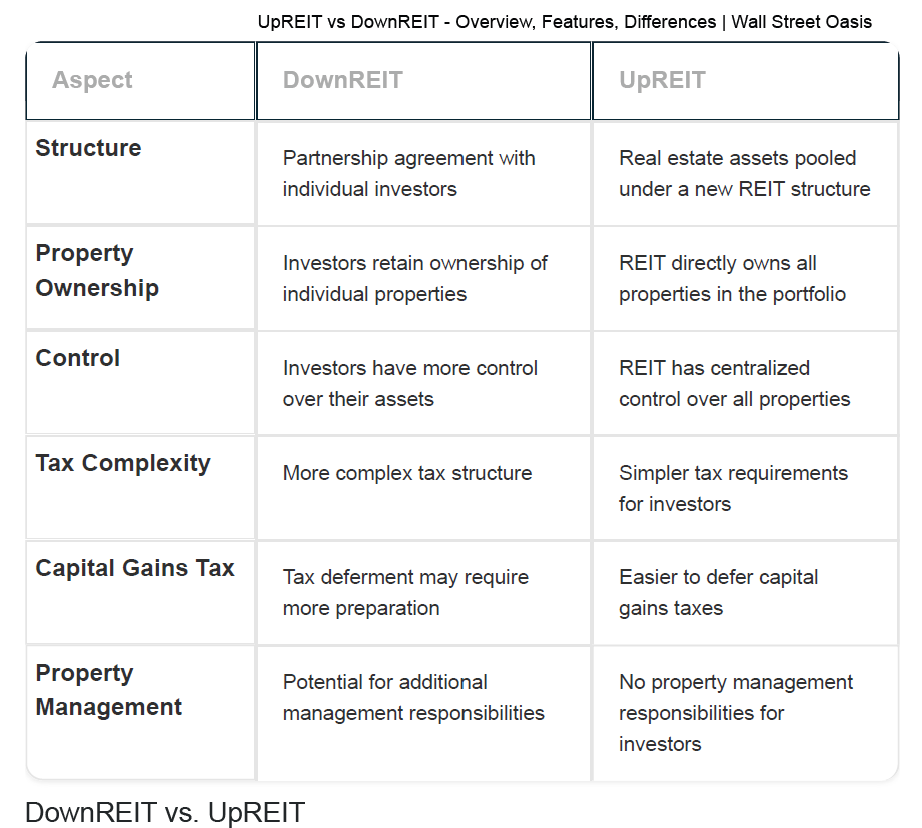

While both structures allow property owners to contribute assets to a REIT framework, they operate under distinct models with unique control, taxation, and liquidity implications.

Table #1 is retrieved from UpREIT vs DownREIT (6)

Tailored Arrangements

DownREITs offer property owners more flexibility in structuring the partnership based on the specific performance of their properties. This customization allows owners to control operational and financial decisions while benefiting from REIT ownership (6). Conversely, UPREITs pool all contributed assets under a single REIT structure, reducing individual control but providing broader investment exposure.

Property Ownership and Diversification

In a DownREIT structure, investors retain ownership of individual properties rather than pooling them under a centralized entity. This can limit diversification since property performance remains tied to specific assets. In contrast, a UPREIT allows investors to contribute properties in exchange for OP Units, providing exposure to a professionally managed, diversified portfolio of real estate assets.

Control Over Assets

DownREITs allow property owners to retain decision-making power over their assets, which is typically impossible in a UPREIT structure. Investors who prioritize maintaining control over management and financial operations may find DownREITs a more attractive option. However, in a UPREIT, control is centralized within the REIT’s management, offering a hands-off investment approach while providing liquidity benefits.

Tax Complexity and Capital Gains Considerations

DownREITs often involve a more complex tax structure, requiring additional planning to ensure the deferral of capital gains taxes. The tax implications of a DownREIT may also vary based on the structure of the partnership agreement and future property sales. On the other hand, UPREITs simplify tax treatment for investors, as OP Units provide a more straightforward pathway to deferring capital gains taxes under Section 721.

Liquidity and Property Management Responsibilities

Liquidity can be a concern in DownREITs, as ownership is tied to specific assets, making it harder to exit the investment without selling the underlying property (4). UPREITs provide greater liquidity by allowing OP Unit holders to convert their interests into publicly traded REIT shares. Furthermore, property owners in DownREITs may face additional management responsibilities, whereas UPREIT investors enjoy passive participation without the need for direct property oversight.

Conclusion

REITs have transformed real estate investment by providing investors access to large-scale, income-generating properties while offering liquidity, diversification, and tax advantages. UPREITs enable property owners to defer capital gains taxes and gain exposure to a professionally managed portfolio. In contrast, DownREITs offer greater control over specific assets but come with added complexity and liquidity challenges. Both structures present unique benefits and risks, making it essential for investors to align their choices with their financial goals and risk tolerance. Whether opting for a UPREIT or a DownREIT, a well-informed strategy and careful planning are key to optimizing investment success.

References:

CCA Advisors, UPREITs: Unique real estate investment structures. Retrieved from https://cca-advisors.com/upreits-unique-real-estate-investment-structures/

Velaw.com, Why do property REITs have operating partnerships? Retrieved from https://media.velaw.com/wp-content/uploads/2019/11/28180433/c14d6fbb-276d-49e3-889b-16930b4e1945.pdf

Origin Investments, What is a 721 exchange? How an UPREIT works. Retrieved from https://origininvestments.com/what-is-a-721-exchange-how-an-upreit-works/

REIT.com, How to invest in real estate investment trusts (REITs). Retrieved from https://www.reit.com/investing/how-invest-reits/

ResearchGate, Value creation and governance structure in REIT mergers. Retrieved from https://www.researchgate.net/publication/5151803_Value_Creation_and_Governance_Structure_in_Reit_Mergers

Corporate Finance Institute, UpREIT vs DownREIT. Retrieved from https://corporatefinanceinstitute.com/resources/commercial-real-estate/upreit-vs-downreit

More about the Author: Collin Dallas – Wu